Are Medicare Plan F policies are considered first-dollar coverage?

- Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible

- It covers all of the 20% that Medicare Part B normally leaves for you to pay

- Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services

- Choose any doctor – from over 880,000 physicians in the United States

- No referrals required! Medigap plans allow you to see any Medicare specialist whenever you like. You are not required to get a referral from your primary care doctor.

- Guaranteed renewable. Your coverage can never be canceled due to health conditions or the number of claims you file.

If a specialist sends me to an imaging facility to have an MRI done and Medicare pays 80% of the cost of my MRI will my MEDIGAP kick in?

Yes, if your medicare part A and PArt B pay, your medicare supplement will kick in to help cover the medigap.

How Much Does Medicare Plan F Cost?

Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we find pricing around $120 – $140/month for a female turning 65, but it’s always important to get quotes for Medicare Plan F cost in your area.

With most carriers, the Medicare Plan F cost for males will be slightly higher than females. Tobacco users of course will often have a higher Medigap Plan F cost than non-tobacco users. There are also a number of companies who offer household discounts for their Medicare supplement policies.

We often run into individuals who have been on Plan F for several years. Because the coverage is so good, they find themselves fearful to change carriers. The good news is that benefits for Plan F with one Medigap company will be exactly the same as benefits with a Plan F from a different company. This means you should be comparing the Medicare Plan F cost between insurance companies annually and looking for the cheapest Medigap Plan F in your area.

An annual review of Medicare supplement Plan F rates in your area can save you a bundle over the years.

Do I have to go through underwriting if I change Medicare Supplement Plans?

Changing usually requires answering health questions with the new Supplement F company. However, we find that a large majority of our clients pass the underwriting with no problem.

Be sure to work with a service like ours that will shop your Medicare Supplement Plan F cost every single year. Our software can generic a quick Plan F rate comparison. We can compare this with other popular plans like G and N to see which has the best value. With over 100 plan options you might consider calling the medicare supplement helpline.

Which Medicare Plan is Best for You Medicare F or Plan G?

Quite often, we find that our clients can sometimes save $200 -$300 per year by looking at the next option down... So what is the difference between Medigap Plan F and G and which is better? The coverage is very similar to Medicare supplement Plan F with one minor exception: the Part B deductible. On Plan G, you pay the once-annual Part B deductible yourself. However the premiums can be quite a bit cheaper, and you pocket the savings.

What Does Medicare Plan F cover?

It covers all of your cost-sharing for Medicare Part A and B services. Because you are an ADS Lifestyle member you will receive additional discounts on your prescription sunglasses. Does Medicare Plan F cover chiropractic?

Yes, Medicare covers 80% of adjustments, and Plan F pays the other 20%. Medicare does not cover other services provided by chiropractors though, such as x-rays.

What are the top 10 Medicare supplement insurance companies in 2019?

No. Plan G covers less than Medicare supplemental Plan F. You pay your own Part B deductible. However, you get lower premiums for Plan G, and sometimes that makes it a better value. Be sure to compare the numbers. In my opinion, the best Medicare plan is the one that will cost you the least annual out-of-pocket spending and has the lowest rate increases in recent years.

Is Medicare Plan F going away?

Lots of people ask us about Medicare Plan F going away. Yes, in 2020, they will phase out Plan F. It will be no longer be available for new enrollees. Medicare beneficiaries who are already enrolled in it, though, will be able to keep it. Congress passed legislation that will no longer allow Medicare supplement policies to cover the Part B deductible for newly eligible Medicare beneficiaries on or after January 1, 2020.

So should you join Plan F before it gets discontinued? Or would it be better to enroll in Plan G since it will be around long-term?

There are agents out there who will try to switch you out of Plan F by using the coming 2020 changes as a scare tactic. Don’t let anyone panic you. You should enroll in the plan that makes the most financial sense for you. We advise you to get quotes for both plans, which is what we do for our clients here.

We often find that Plan G is actually a better value. The premiums you save annually on Plan G are often more than the Part B deductible that you pay out. If that’s the case, then we think that enrolling in Plan G makes sense.

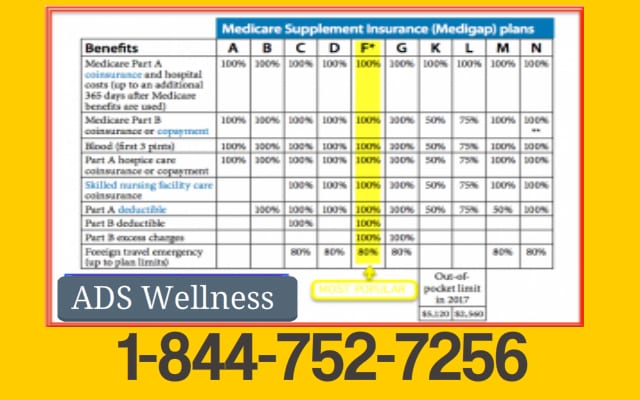

What are the Medicare Supplement Plan Options?

Medicare Supplement Plan Comparison Chart

Do Medicare Supplements cover Prescription Sunglasses?

Not all plans cover prescription and very few cover prescription sunglasses. If you are over 65 and on Medicare ADS Eyewear would like to help you with a $50.00 coupon on any of our Oakley or Randolf Prescription

Sunglasses Made in America.

how much does it cost for medicare supplemental insurance?

Medicare Supplemental Insurance ranges in cost from $29.00 to $199.00 a month starting our at 65 going up depending on your age, location and plan choice. The M

edicare Plan F is typically the most expensive and the Plan F (High Deductible) is usually the least expensive.

Reviews

There are no reviews yet.